Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

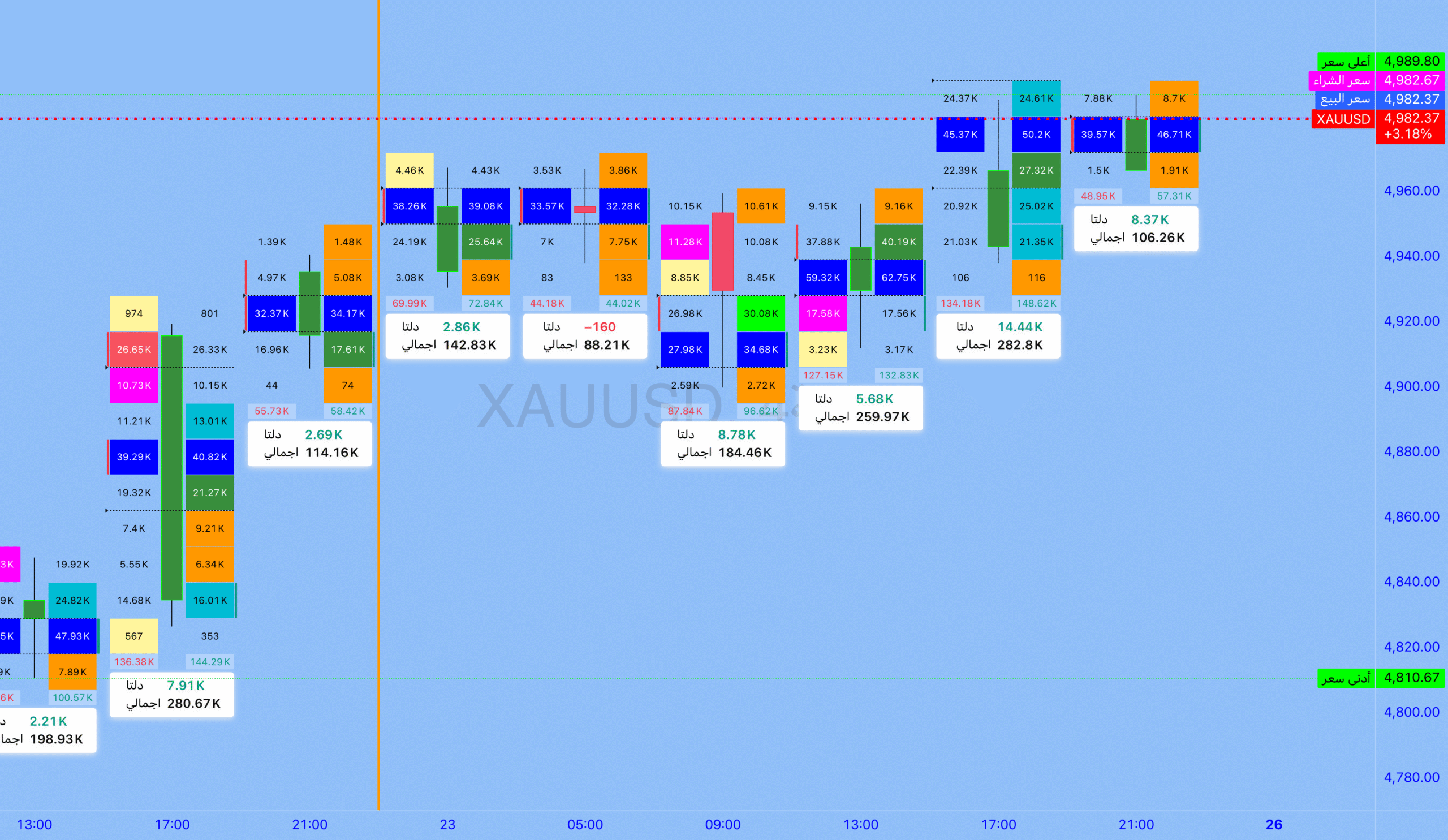

0) Quick snapshot (from your watchlist)

– Saturday (XAUUSD): 4,982.37 | GC1: 4,979.70 | GC2: 5,017.00

– Spread (GC2–GC1): +0.75% → Contango | Difference (Spot–GC1): +2.67

– Overall picture: USD lower + yields lower (background supports gold), but VIX higher (more tail/sweep).

GC1/GC2 quick explanation (for average traders)

– Contango = GC2 is above GC1 (normal curve) and is not just a sell signal.

– Backwards = GC2 is less than GC1 (strong spot demand/supply pressure).

– Spread % = slope of the curve. Use it as context, not a trigger.

1) Idea of the Week (Million Dollar Question)

This week is about acceptance, not direction.

– If the price is known to be higher than the distribution shelf → one week extension is still possible (100%/110% target is possible).

– If the price fails to be accepted and continues to revolve around VWAP and value → the distribution/reversion to the mean for the week remains (the magnet works).

The real difference is: Can the market “save a job”?

2) HTF diagram (see where the heavy money is)

The Frame for Implementing Justice (Line of Truth):

– 4-hour trading volume: approximately 4,979.7

Rule: Above it + Repair = Shorts are bought. Below + Mount = Subsequent Bounce.

Distribution/display stand (trap place):

– 4,988.5–5,000.0 = Main distribution rack

– 5,015.1 = 100% continuation gate (recycling + accepting turns this week into an extension)

Fixed/restored mean ladder (must be installed and purchased here):

– 38%: 4,976.4–4,976.9 (best first bear market if trend is healthy)

– Liquidity: 4,972.5–4,969.5 (monitored cleaning/recycling)

– Structural Rating: 4,961.6 (if installed under → enters repair next week)

– 62%: 4,946.8 (reload my founder if this idea still makes sense)

– 50%: 4,925.8 (deepest break of the week)

3) Auction logic (POC/VAL/VAH/VWAP – in which week the transaction should be conducted)

– Above VAH + Acceptance = Premium Auction → Logical continuation.

– Value return after hacking = auction failure → return to POC/VWAP.

– Under VAL + Acceptance = Repair Week → Deeper Magnet.

Practical reading:

– If every trip comes back to VWAP again: no trend (distribution).

– If price remains above VAH and stops, then returns to VWAP/POC: Trend (Extended).

4) Ichimoku filter (HTF decides, LTF executes)

– Uptrend: Above the Cloud + TK Up + Chikou Added → Buy Retstat and put it on the shelves (VWAP/38/50).

– Ring/Repair: Cloud/Level Kijun/Tangled Chikou → Vid Racks and TPq Badri.

– Downward trend: Yunxia+Kijun top+Chikouxia→Sell on high, no short buying except pre-acceptance+acceptance.

5) Vape-Kicker (Real Weekly Rules)

Anchor base:

– We mount the vape from the first MegaBar in the chain in the same direction; the following MegaBars are consecutive and do not change the anchor point.

Use of ladders:

– 0% = Allow line to continue.

– 38/50/62 = Reload gate (trend remains unchanged if captured on reload).

– 100/110 = Expansion Door (touch is not enough… needs to be accepted).

– 125/R2 = late stretch ceiling (no chasing).

6) Execution Plan (MTF – Calibration Item)

This week’s highest quality entries will be from one of two models:

Form A – Recycling/Acceptance

– Requirements: Lock 15m/1H and above 4,988.5–5,000 + installed.

– Triggers: Shelf Reset + Bullish Recovery Candle.

– Target: 5,015.1, then 5,033–5,037.

Model B – Fade Distribution

– Condition: Sweep above 5,000 then below 4,988.5 fails or installs under VWAP.

– Trigger: Reset failure + lower high.

– Magnet: ~4,979.7, then 4,972–4,969, then 4,961.6, then 4,946.8.

Risk Agreement (XAUMO):

– SL1 (attenuation) = immediately after rack failure.

– SL2 (Tailgate) = With the chassis in the pocket, this invalidates the idea.

– TPq First of all, especially now that VWAP is so popular.

7) Study Scenario of the Week (Educational Examples – Not Signs)

A) Extended week (need to accept)

– Hold above 4,988.5–5,000 + retest hold → 5,015.1, then 5,033–5,037.

B) Allocation week (auction failure)

– Fails above 5,000, returning below 4,988.5 → ~4,979.7, then 4,972–4,969, then 4,961.6.

C) Healthy Reload Week

– Dropped to 4,976–4,969, then VWAP recovered → back to 4,988.5, then 5,000.

D) Maintenance week (deeper re-quoting)

– Installed under 4,961.6 → 4,946.8 then 4,925.8.

#GOLD #XAUUSD #GOLD #XAUMO #VWAP #Ichimoku #Fibonacci #Volume_Profile #Price_Action

🏆 The winner trades using the XAUMO indicator