Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

From a macro perspective, geopolitical uncertainty remains high following President Trump’s recent remarks about strengthening U.S. control over the strategic military region of Greenland. While this does not imply outright capture, the development adds to broader risk sensitivities and supports gold’s role as a defensive asset.

Market structure and technology background (H3)

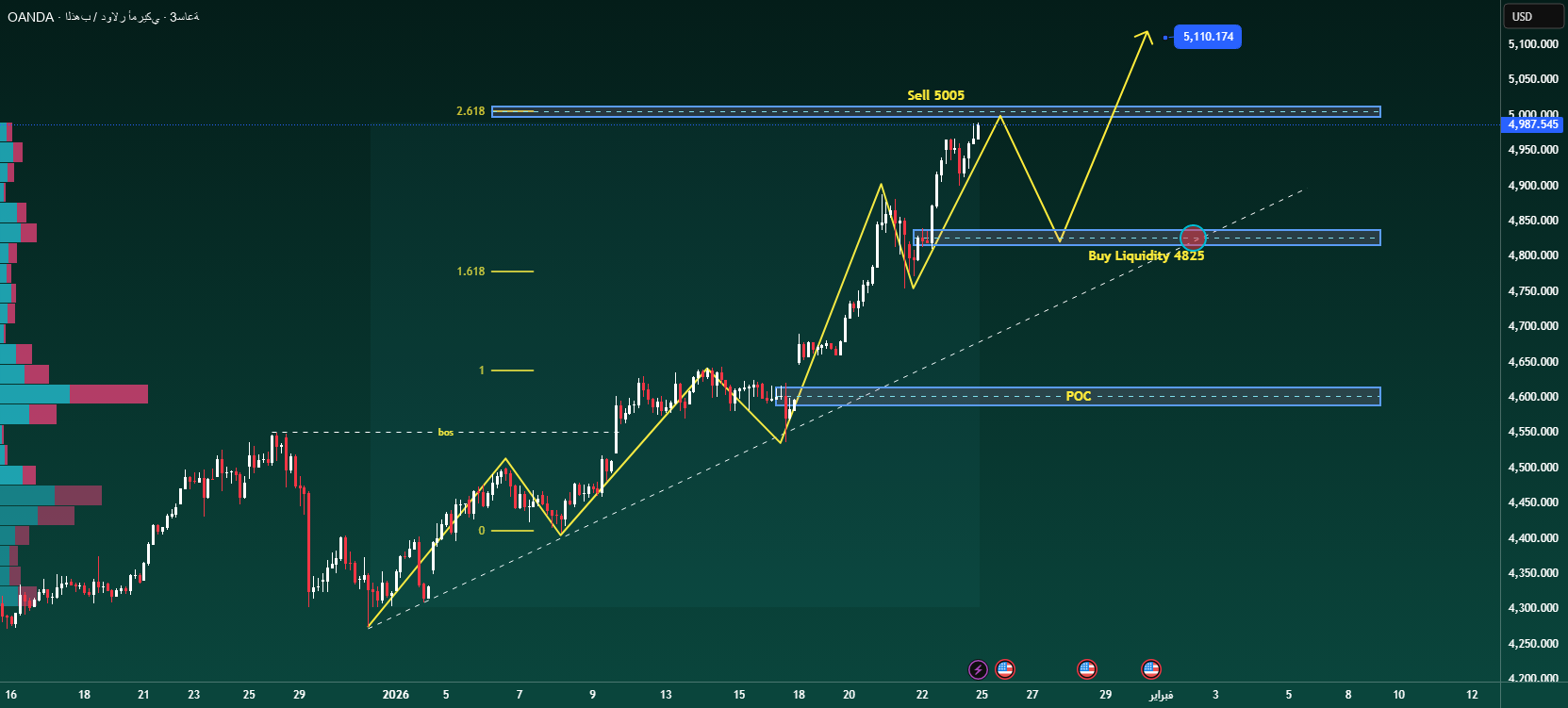

On the H3 chart, XAUUSD remains above its uptrend line, with the market structure defined by higher highs and higher lows. A breakout of the previous structure (BOS) confirms the continuation of the uptrend and opens the door for further expansion.

Key technology areas highlighted in the chart:

The strong pulse leg was followed by a corrective pullback, consistent with the continuation of the trend.

The Fibonacci extension extends around the 5005 area to 2.618, which is a major area of interaction.

The declining liquidity area is around 4825, which is in line with trend line support and suitable for continuation scenarios.

If volatility increases, the lower value/POC areas will act as deeper support.

As long as price remains above these demand areas, the broader bullish structure remains intact.

Liquidity and future expectations

Upside liquidity remains above recent highs, and the short-term pullback may be driven by profit-taking rather than structural weakness. The 5000-5005 area represents a key decision-making area where price may pause or consolidate before moving in the next direction.

trading trends

Basic Trend: Bullishness will continue as long as the structure remains intact.

Main monitoring scope:

4825 – Liquidity declining/trend continues

5000-5005 – Main extension and interactive areas

Preferred time frame: H1-H4

Risk management remains critical, especially in markets sensitive to breaking news flows.

See the attached chart for details on market structure, liquidity areas, and Fibonacci extensions.

Follow the TradingView channel for early updates and join the discussion on market structure and price action.