Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

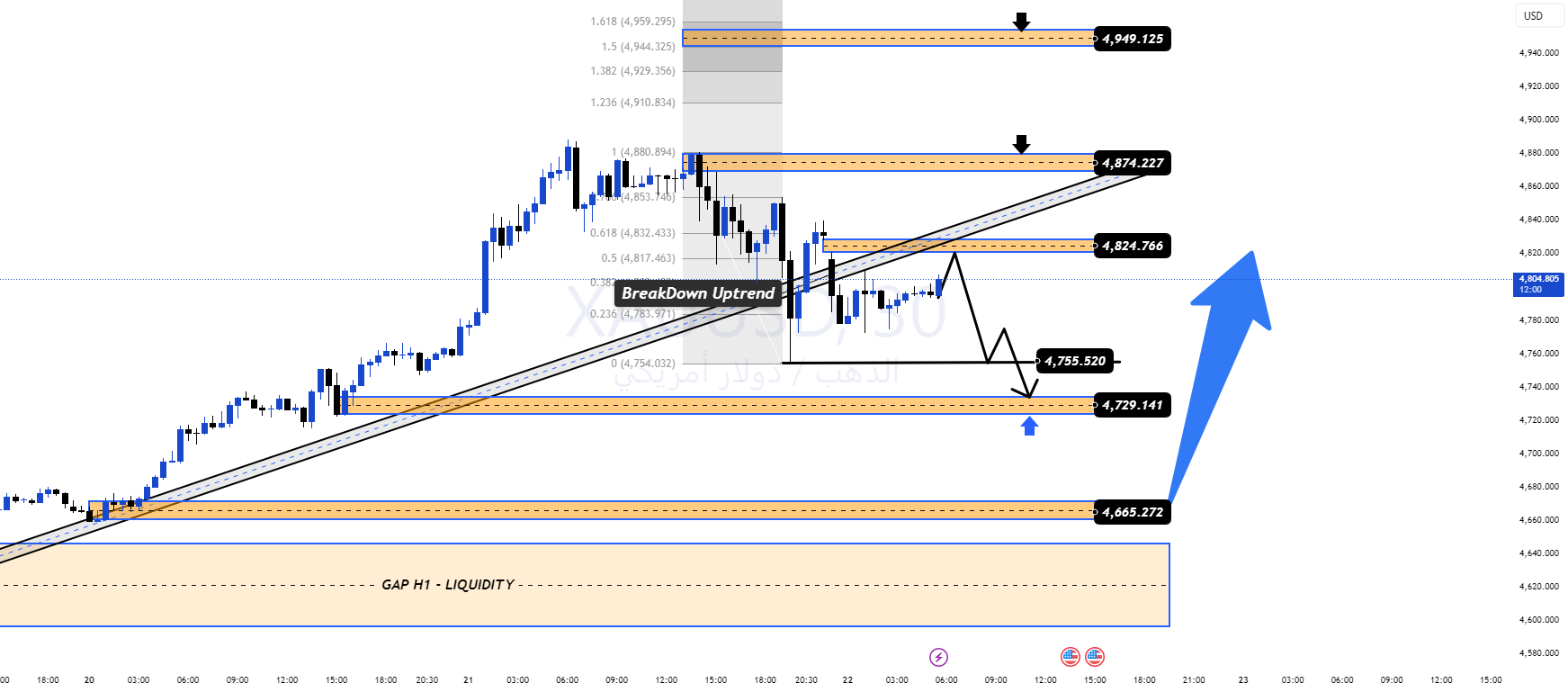

After experiencing a strong and strong rebound, gold prices fell below the short-term uptrend line, indicating the entry of a technical adjustment and liquidity rebalancing phase. However, the upper time frame structure remains intact and the current decline is still viewed as a correction rather than a trend reversal.

From a fundamental perspective, safe-haven demand and dovish monetary policy direction continue to support gold prices. This makes sharp declines more attractive for institutional accumulation rather than aggressive selling.

Structure and Price Currency (H1)

The short-term upward trend line is broken → enters the correction stage.

There are currently no confirmed bearish signals in the first half.

Prices trade within a certain range, targeting the liquidity pool below.

There were multiple demand + liquidity + gap (GAP) areas in the first half below current prices.

The upper area remains an interactive potential sell-off/liquidity zone.

Key levels worth paying attention to

Sales/Liquidity: 4,949 – 4,874

Average reaction area: 4,824

Primary buying area: 4,755 – 4,729

Deep Buy Zone (1H Gap – Liquidity): 4,665 – 4,600

Trading Plan – MMF Style

Main scenario – buying at a discount

Find your purchasing settings at:

Buying Zone 1: 4,755 – 4,729

Buy Zone 2: 4,665 – 4,600 (1H Gap and Liquidity)

Only enter after a clear bullish reaction and structural preservation.

Avoid entering the market prematurely when the price remains in the mid-range.

higher goals

TP1: 4,824

TP2: 4,874

TP3: 4,949 (beyond higher liquidity)

alternative

If the price fails to reach the lower zone and remains above 4,824, then wait for a breakout and retest a buy strategy back in the direction of the trend.

Cancel

A first-half close below 4,600 would invalidate buying sentiment.

Take a step back and reassess the overall structure of the market.

generalize

Overall bullish sentiment remains unchanged, and the current move represents a healthy correction in liquidity absorption. The best strategy is to be patient – buy when the discount is confirmed rather than chasing the price.