Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

🌎The company is making some progress. In the third quarter of 2025, revenue increased by 3.5%, the fastest growth rate in four years, and operating profit margin increased by 1.7 percentage points to 24.7%.

Sales of products launched in the past five years grew 30% in the quarter.

The appointment of new CEO William Brown and his focus on operational efficiency, including increasing the supply ratio to 91.6% (the highest level in 20 years), have been well received by the market.

Solventum’s strategy of separating its medical business from its predecessor businesses allows it to focus on its core competencies.

Annual revenue growth is expected to be only about 2-3%, well below the roughly 10% growth rate in the broader U.S. market.

Net profit margin fell to 13.7% from 15.9% last year.

3M’s price-to-earnings ratio is about 26 times, much higher than the industry average of 12.9 times. This suggests that significant expectations for future growth are baked into current prices. Any disappointment could result in a significant price adjustment.

The share price rise was mainly driven by positive expectations for the appointment of a new CEO and was not supported by financial results.

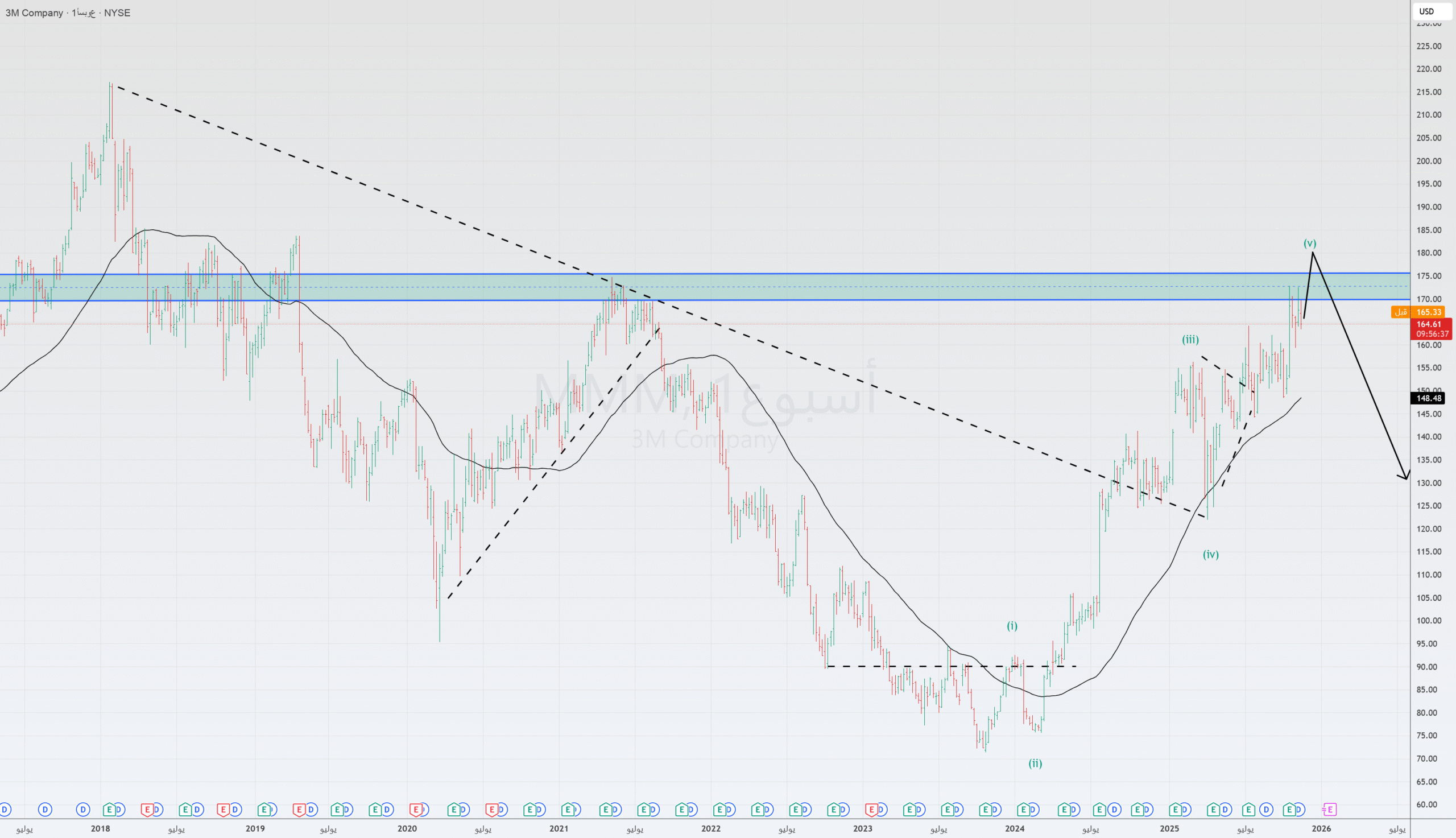

We are in the fifth wave.

Considering the company’s current performance, the current share price valuation is relatively high.