Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Market background

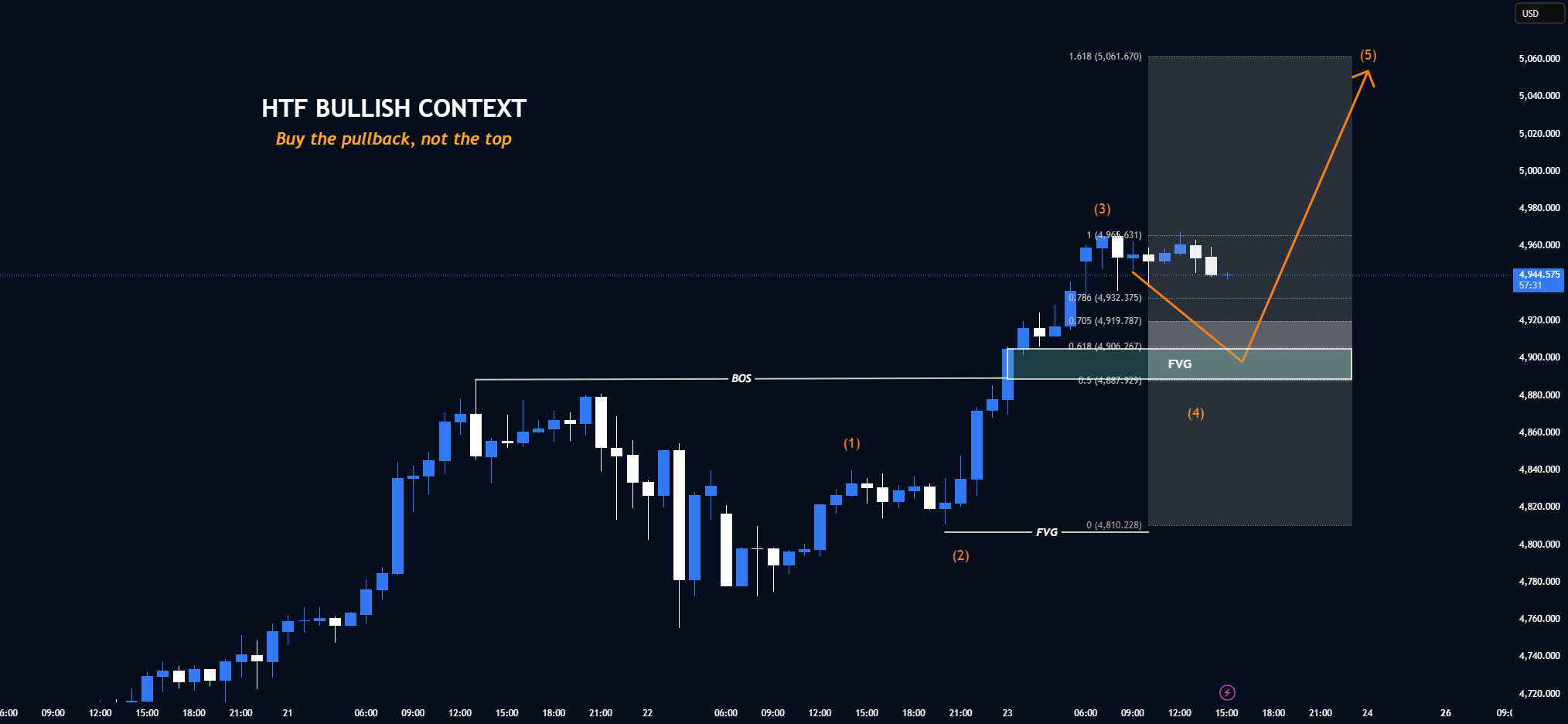

Gold remains within a strong bullish structure on the higher time frames.

Momentum comes from continued risk flows and continued demand for safe assets.

In this environment, pullbacks are opportunities, not signs of reversal.

Technical structure (HTF→LTF alignment)

The price previously confirmed an upward breakout structure (BOS).

The recent impulsive leg created a clear bullish value gap (FVG).

Prices are currently consolidating below 4,953, indicating a corrective pullback rather than a distribution.

As long as the price remains above the main demand area, the structure remains unchanged.

Key Levels (Decision Areas)

Current high: 4,953

Shrinking Retracement Zone (FVG): 4,906 – 4,887

Deep support/structural bottom: 4,810

Upward forecast (1.618): 5,061

Scenario (if – then)

Base case – bullish continuation

If price reacts and remains above 4,900

FVG is respected → continues to extend from 4,953 to 5,061

Alternative Scenario – A Deeper Recession

If the price loses 4900

Expected to fall further to 4,810

Unless HTF closes below 4,810, the structure remains bullish

generalize

This is an environment where trends continue.

Chasing peaks carries risks but low rewards.

Buy on pullbacks.

Respect FVG.

Let structure do the work.