Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The Federal Reserve completed its second interest rate cut in 2025 on October 29, lowering the benchmark interest rate by 25 basis points and locking the current interest rate range at 3.75%-4.00%. Minutes of the October meeting of the Federal Open Market Committee (FOMC) released yesterday showed that members had major differences on whether to launch a new round of interest rate cuts in December. The main sticking point is that while economic indicators are stable, upward pressure on inflation is the main concern. The minutes of the meeting particularly emphasized the importance of managing long-term inflation expectations. Continuous interest rate cuts may make it difficult to manage these expectations, causing inflation to get out of control and offset the results of the Fed’s previous interest rate hikes to combat inflation. Two members voted against the decision to cut interest rates: one member called for a 50 basis point cut instead of 25 basis points, and the other member called for keeping the current target rate unchanged. All members affirmed their commitment to the Fed’s dual mission of achieving full employment while keeping inflation at 2 percent. An important background is that after last month’s policy statement, Federal Reserve Chairman Powell made it clear that another interest rate cut in December was “uncertain”, making room for policy adjustments. When interest rate cuts are controversial, it will naturally have a negative impact on gold, a non-interest-bearing asset, thereby increasing the opportunity cost of holding gold.

Gold price analysis:

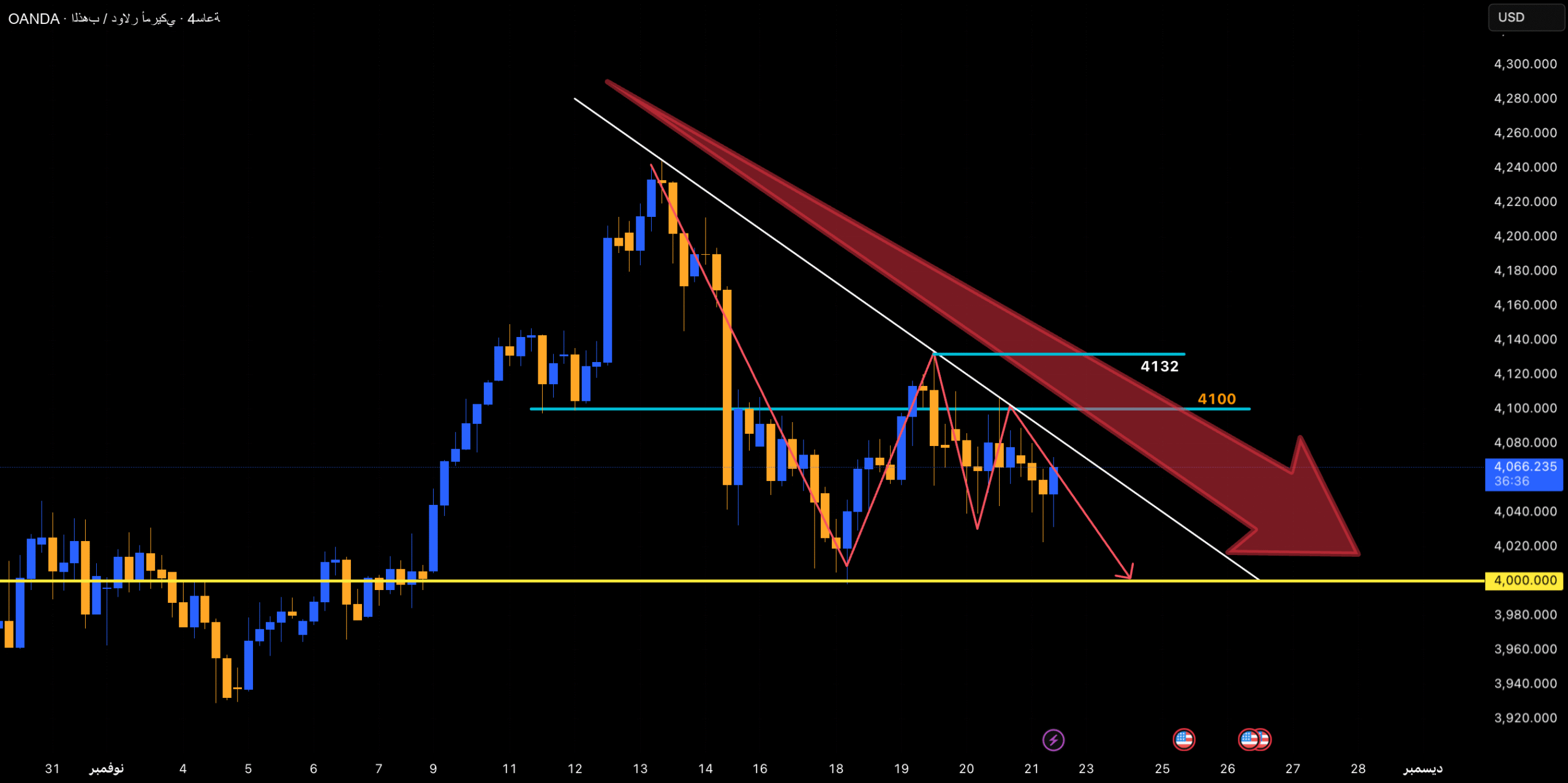

Gold has been correcting since $4,381. Last week, it bounced back twice to test the $4,250 level. I always thought this was just a bounce, not a real uptrend! I am not optimistic that gold prices will reach new highs in the fourth quarter and that this correction will last longer than most people expect. After rebounding this week and encountering resistance at $4,130, gold prices rose again after the release of non-agricultural data yesterday, encountered resistance at $4,106, and are currently trending lower. In the short term, this is a downtrend, not an uptrend, and many are still clinging to a bullish mindset.

During the day, gold was slightly weaker in the short term. This is another drop after a rebound this week to around $4,130. Gold prices are likely to break above Tuesday’s low of $4,000. Even if there is no breakthrough, or if there is a breakthrough, the decline will be limited. The buying reference point should be the $4,000 level; there is simply no room or value to buy at other levels. Gold is currently consolidating in the 4000-4100 range in the short term. Whether buying or selling, the strategy should be short-term; don’t hold a position indefinitely. Over the long term, large one-sided trends are unlikely; this is crucial to understand.

We have emphasized many times recently that the $4,000 level will be exceeded, and we also believe that $3,886 is not the lowest level recorded recently. In an unexpected situation, we need to be careful if gold prices break through the 4100-4110 area. In the short term it will strengthen, test Wednesday’s high and the upper edge of the convergence triangle, before falling again. This is our overall golden strategy. Currently, looking at the daily chart, within the triangle pattern, we are leaning towards an uptrend followed by a downtrend. As mentioned earlier, the main area of focus is 4100-4110. Multiple attempts to break above this level have failed this week, suggesting significant selling pressure above this level. Therefore, I maintain a bearish outlook until it breaks above 4100. The key support level below is currently very clear, in the 3998-4000 area. The bulls are likely to provide some resistance and rebound before breaking above this level. However, if broken, I personally believe that the uptrend support from $3,886 could collapse. This means that the lower edge of the converging triangle pattern may collapse above the $4,000 level; other bearish targets are the 3915-3950-3980 area. In short, today’s short-term gold trading strategy is mainly to sell on highs. In the short term, the main focus is on the resistance level 4100-4110 and the main support level 4030-4000. Please pay close attention to trading signals.