Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

🔍Technical Reading

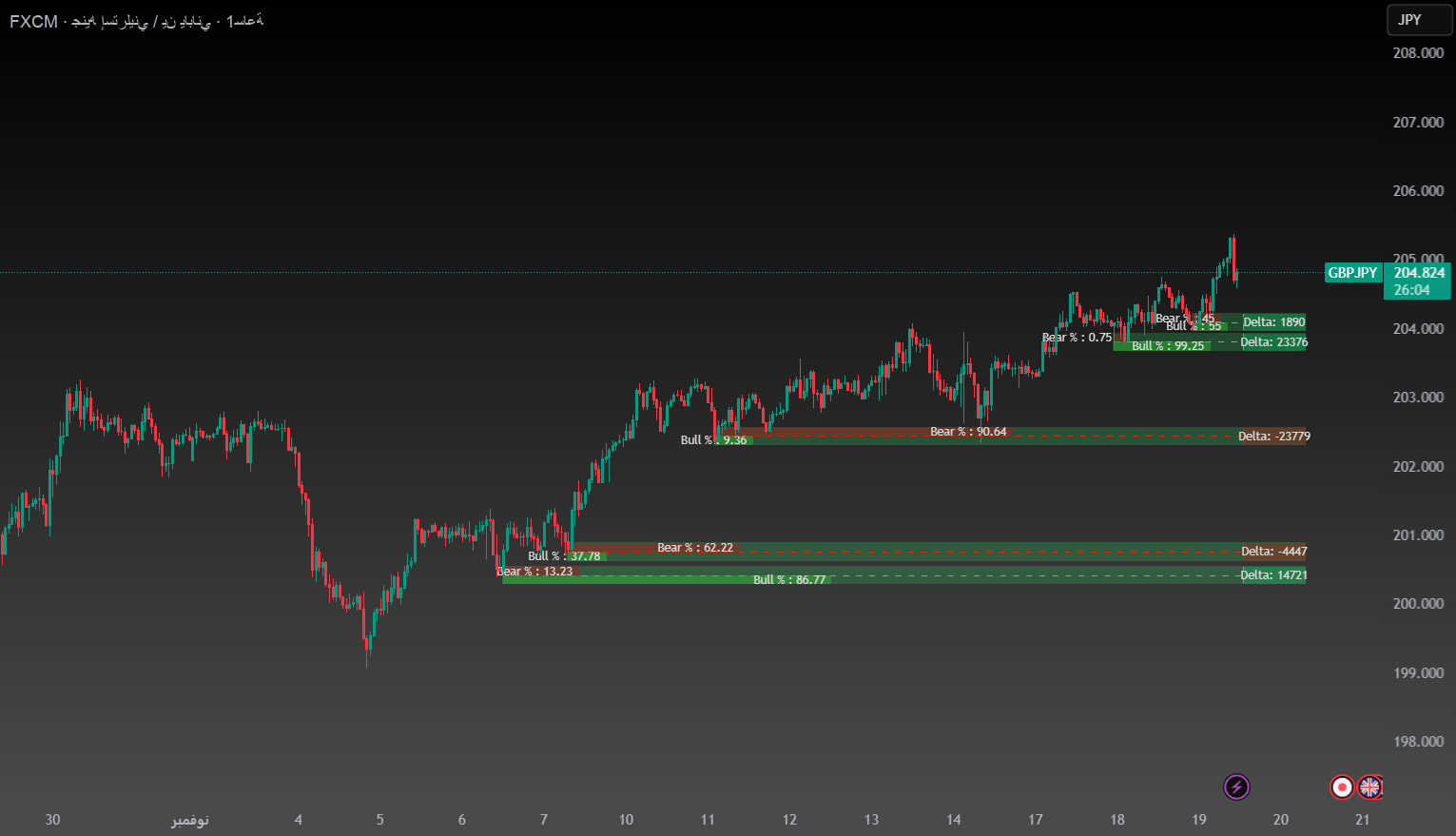

After forming consecutive rising lows, the overall trend of the pair is clearly bullish and the price action is under control, confirming the continuation of buying control.

Currently, the price is approaching an important resistance area near 205.00 and may slow down temporarily before attempting to break above this area.

🔹Nearby demand areas (supported):

203.80 – 204.00

An area of short-term secondary support for the recent price rebound, with strong positive delta values enhancing the chances of a rebound.

202.00 – 202.50

A major support area that represents the basis upon which the current rise will eventually begin.

200.80 – 201.20

Deeper and stronger support, a breakout would change the bullish structure for the pair.

🔹Supply (resistance) area:

205.00 – 205.50

Current resistance is the most prominent challenge facing buyers.

A clear closing above this level could push the price towards 206.50 – 207.00 as an upcoming extension wave.

📈 Most likely scenario (continued rise)

As long as the price is above 203.80, the preferred scenario remains to continue the bullish momentum:

First target: 205.00

Second target: 206.50

Third goal (extension): 207.00

Positive momentum and incremental buying clearly support this trend.

📉 Alternate scenario (limited fix)

If the pair fails to break above 205.00, we may see a minor correction towards 204.00 or even 203.50 before buyers return again.

📌Conclusion

Current Trend: Strongly Bullish

Main support levels: 203.80 – 202.00

Resistance: 205.00 – 206.50

A Closer Look: Barring a Break Below 203.80, Rally Will Continue

✍️ Technical Analysis: Taher – TPS Academy