Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

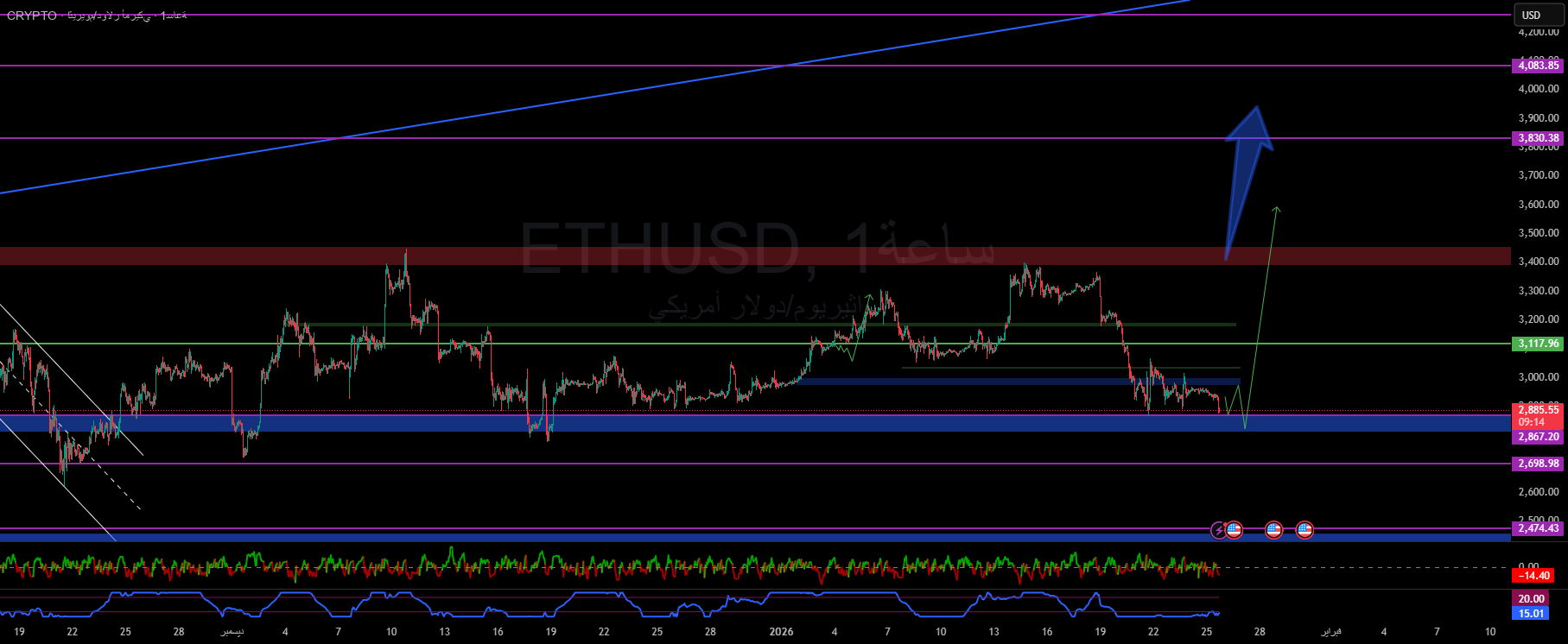

📐Joint parts

Main demand area: 2,900 – 2,860

This area represents the last line of defense before expanding the range.

Extended critical support: 2,867

Close top = install bottom.

Balance zone: 3,050 – 3,120

Staging area: 3,300 – 3,420

Heavy duty width (breakout key): 3,830

Higher target (expanded control area): 4,080+

🧭 scene

Most likely (approved):

2,900 – 2,860 range consolidation → Periodic rebound to 3,120 points, then 3,300 points. If there is an obvious breakthrough, it will lead to 3,830 points, and then 4,080 points.

Alternative (low probability):

Breakout and close below 2,860 → Liquidity retreats further to 2,700 – 2,680, which will only activate with a clear breakout and close.

🎯 Administrative advice

Intelligent progressive entry: 2,920 → 2,880

Stop loss: hourly close below 2,860

Target:

TP1: 3,120

TP2: 3,300

TP3: 3,830

TP4: 4,080+

🧠 Annotation control

The market doesn’t reward speed…it rewards those who understand where contracts are silently collected.

Ethereum doesn’t need courage right now, but discipline and waiting for a decision.

Mohammad Halawani 🔱

Chief Market Strategist, Control Institute