Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

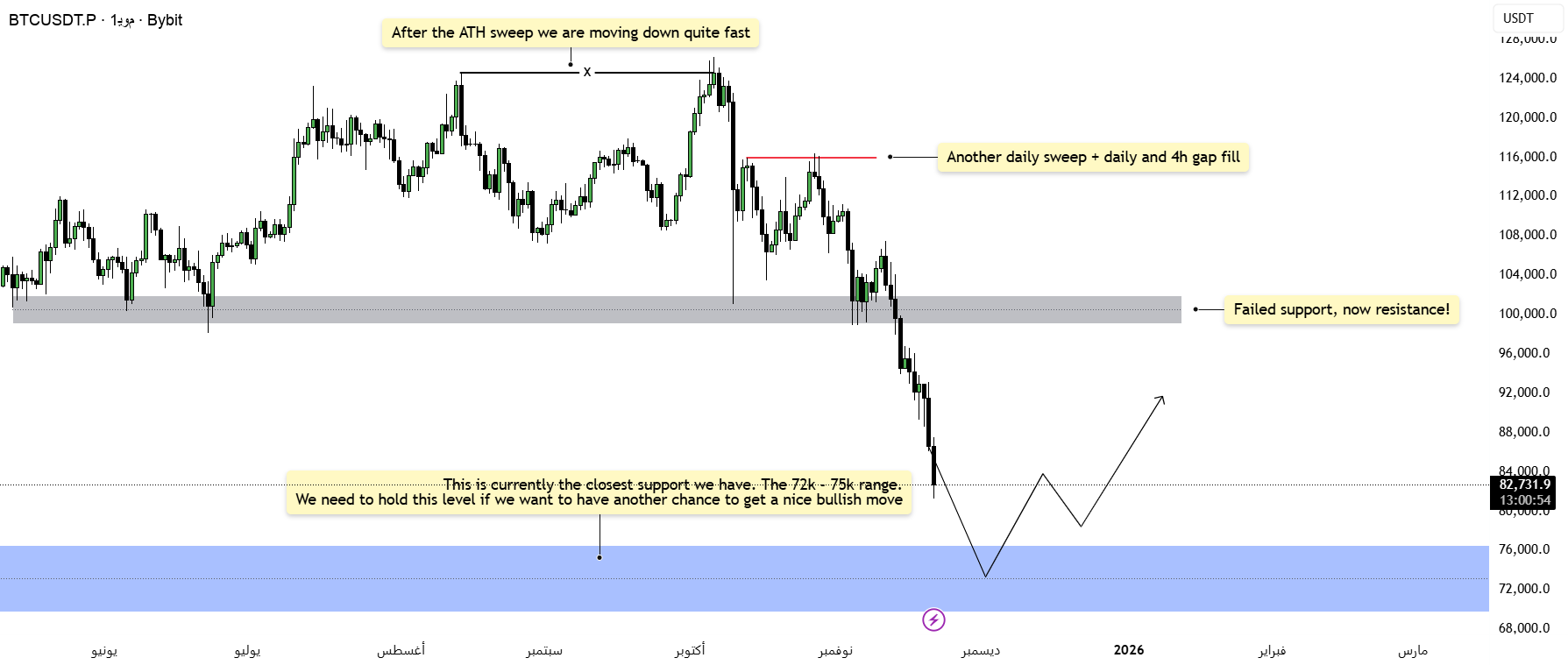

Bitcoin continues to fall after multiple liquidity sweeps, with losses starting to narrow into a more controlled downward move. The chart shows a clear shift in sentiment after the all-time high was swept, and then another daily sweep helped end the imbalance on the daily and 4-hour frames. With the mid-range area lost and viewed as resistance, the market is heading towards the next major area of concern.

unified structure

The structure is currently characterized by a series of distinct lower highs accompanied by sharp, pulsatile lows. These moves were driven by a liquidity grab and subsequent downside, which is consistent with the narrative of finding market demand. The previous gray area of support has turned into resistance, confirming that the current trend remains strong until deeper demand areas are reached.

Main support areas and forecasts

The most important area below the price is around the 72K to 75K range, which is the closest meaningful support remaining on the higher time frames. This area has not been tested since the last major accumulation phase, and as long as price reaches this area smoothly, this reaction can form the basis of a bullish wave. If this area fails to hold, the next support level will be deeper and the downside may accelerate before any recovery can begin.

bullish scenario

If Bitcoin price reaches the 72K to 75K range with clear rejection and bullish returns, the market could set the stage for a strong bullish rally. Ideally, we would see liquidity eventually fall below this range, followed by a sharp change in market structure on shorter time frames. This would open the door for a sustained recovery to replenish the medium-term shortcomings left by the sell-off.

Bearish scenario

If the key area cannot hold, the current support level will fall and the market will head towards a deeper decline. This would shift the bias towards a sustained move lower, targeting unaffected liquidity pools below. In this case, any rebound attempt is likely to be a correction rather than the beginning of a true reversal.

in conclusion

I expect that as long as this level remains stable, Bitcoin price will see a significant upward rebound once it breaks out of the 72K to 75K area. If it fails, the decline will continue towards deeper support, but the higher time frame assumption remains that the next strong reaction will come from this area. Until then, patience is key as the market will take longer to complete its transition to higher demand.