Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

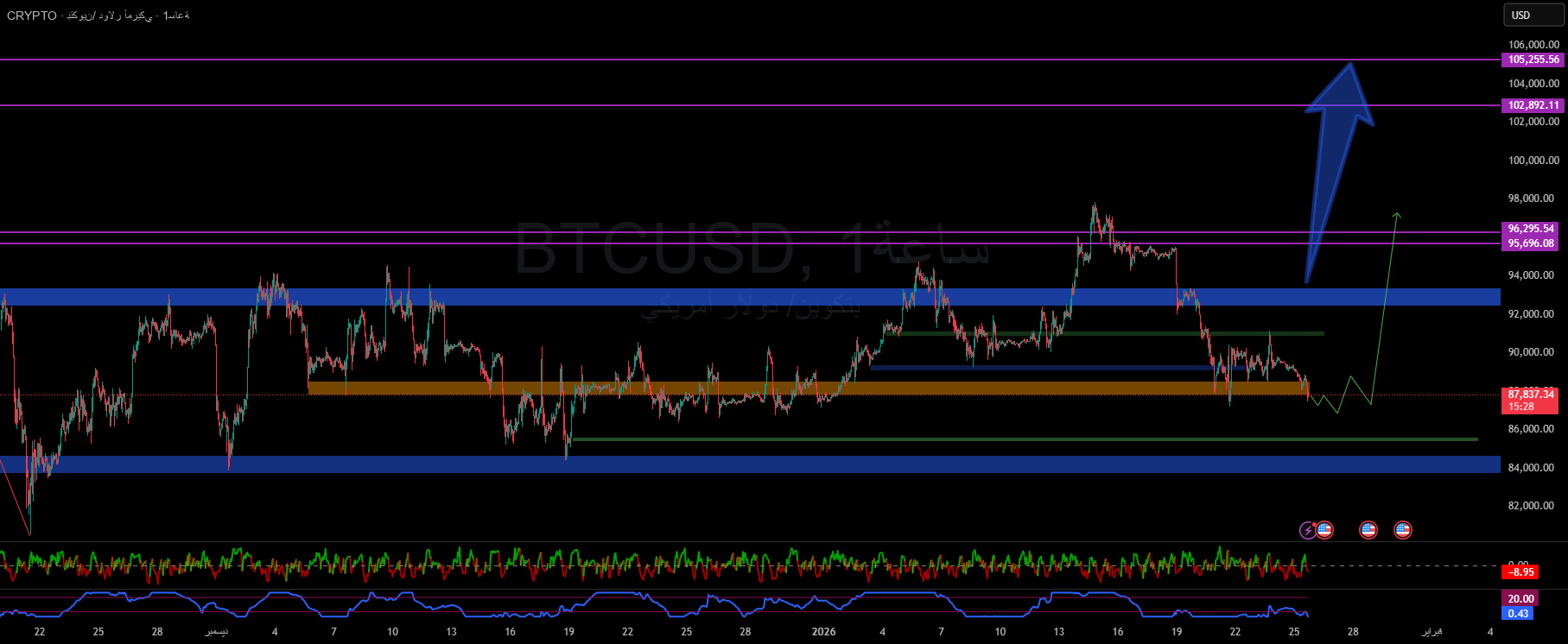

📐Joint parts

Basic needs area: 86,300 – 85,800

Turning it off returns a scenario for evaluation only.

Rebalancing zone: 87,400 – 86,900

This is the place to take smart positions rather than chasing candles.

Mid-term quotation: 90,800 → 92,500

Heavy width (directional joint): 95,600 → 96,300

Control range: 102,800 → 105,250

🧭 scene

Most likely (approved):

Hold above 85,900 → Gradually rise from the absorption low to 90,800 and then 92,500 before testing heavy territory before launching.

Alternative (low probability):

Break through and close below 85,900 points → Retest 84,300 – 83,800 points, confirm absorption before buying from a deeper bottom.

🎯 Administrative advice

Step-in: 87,400 → 86,900

Stop loss: hourly close below 85,900

Target:

TP1:90,800

TP2: 92,500

TP3:95,600

TP4 (extended): 102,800 → 105,250

🧠 Annotation control

Don’t chase sports. The market will either give you a calculated entry point…or show you that you are late.

The decision here is not time, but discipline.

Mohammad Halawani 🔱

Chief Market Strategist | Control Academy