Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Recently, the possibility of the Federal Reserve cutting interest rates in December has declined. Due to the dovish policy stance, the US dollar rose to its highest level since May, causing gold prices to fall sharply, which is not worthy of attention. Minutes from the latest Federal Open Market Committee meeting showed that while some officials favored further rate cuts, others believed further easing could intensify future price pressures. The market subsequently revised its assessment of the policy path, putting short-term pressure on gold prices. At the same time, global stock markets generally showed positive sentiments, and a rebound in risk appetite suppressed the safe-haven demand for gold. However, the data gap in the U.S. economy due to the long-term government shutdown has caused the market to question the dynamics of the real economy. Institutional investors pointed out that “due to incomplete data recovery after the blockade, the actual growth momentum may be lower than the apparent, so gold is still supported.” Under the interaction of multiple factors, although gold prices are under pressure, they have not experienced a unilateral decline. In terms of the geopolitical environment, recent progress in external negotiations has helped improve risk sentiment and restrained the upward momentum of safe-haven assets. The news strengthened the market’s willingness to allocate investments to risky assets, prompting some funds to shift investments from gold to other assets.

Market trend analysis: Today, the much-anticipated non-agricultural report is about to be released! This is not just regular employment data; the US government released employment data for the first time after reopening, attracting huge attention! Why is the non-farm payrolls data so concerning? Picture this: During a government shutdown, a lot of economic data cannot be released normally. Now that the government is finally reopening, this data is like a ray of light in the darkness, revealing the latest situation in the U.S. labor market. Moreover, it has a decisive impact on the future direction of the Federal Reserve’s monetary policy, which means it can cause large fluctuations in the market! Looking at the ADP data released on Tuesday, the focus is undoubtedly on weak employment and rising interest rate cut expectations! However, there are already various speculations and analyzes in the market, and no one can guarantee what the data will show. If the data is much better than expected, it could give the dollar a strong boost. How will equity, gold and commodity markets react? If the data is lower than expected, will expectations for a Fed rate cut increase? Today we will answer all these questions.

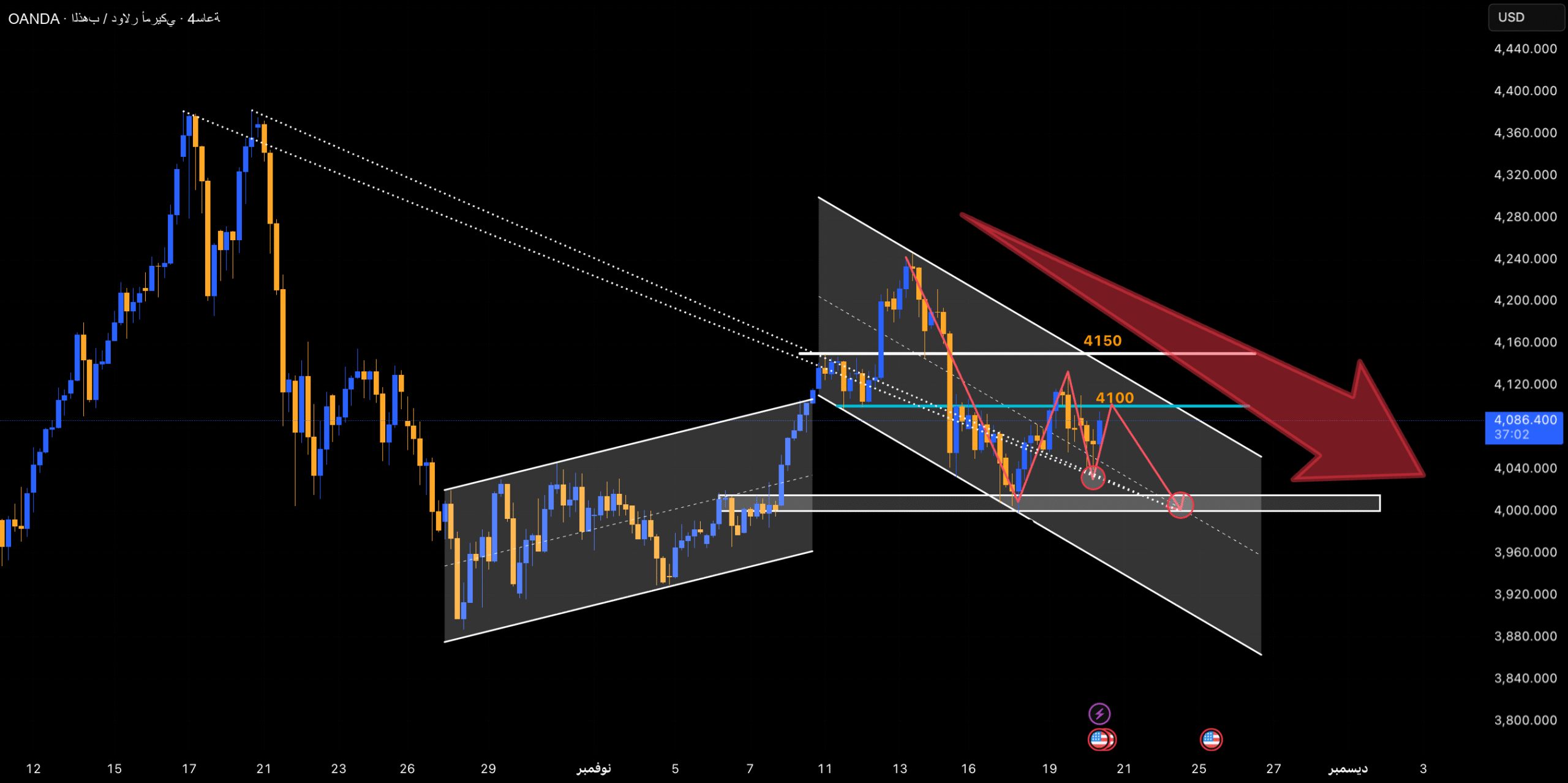

Gold prices have fluctuated significantly in the past two days, but this is in line with our expectations. If you remember yesterday’s analysis, we expected it to rise first and then fall, and the market cooperated. Yesterday we placed three long buy orders, all of which were profitable. Gold prices fell during today’s Asian session. My strategy for today’s Asian session is to sell on highs. This is not a direct unilateral decline, but a decline within a range. Any rebound will be a selling opportunity. Yesterday’s daily chart showed a cross star with a long upper shadow line. The 5-day moving average and the 10-day moving average have converged, indicating that there is resistance near the 4090 mark. My strategy for the Asian market today is to continue shorting near the 4090 mark, with a target of 4000. Gold has formed a two-step bearish pattern. Unless gold prices rise to 4111, the outlook remains bearish. Gold has been very volatile recently, so timing is of the essence. Avoid taking long gold positions before U.S. trading hours; look for short selling opportunities. The real move will come with the US non-farm payrolls data. If the price of gold breaks through the 4000 mark, you can increase your short position. In short, today’s short-term gold trading strategy is mainly selling at high levels, supplemented by buying at low levels. The main short-term resistance level is 4100-4110, and the main support level is 4030-4000. Please keep up.