Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

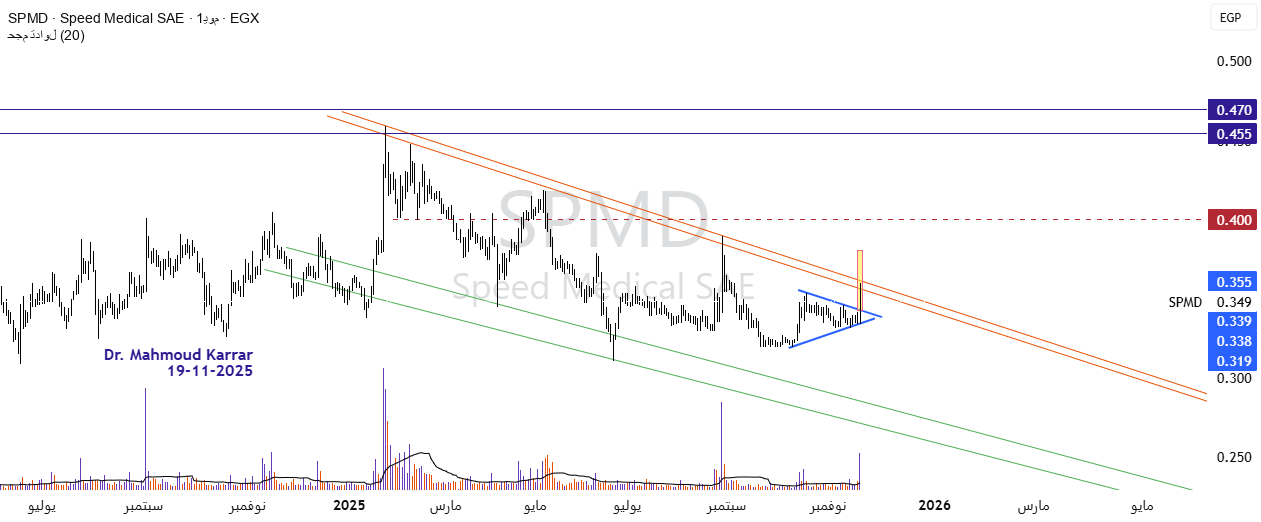

The stock has been trading within a bearish price channel since January 26, 2025, and recently the stock entered a consolidation range in the form of a symmetrical triangle.

The stock managed to break out of this consolidation triangle in today’s trading, which is a positive sign and paves the way towards the £0.38 level as the first target.

But technically the most important thing for the stock is this: a close above the £0.354 level is a change in market structure and the formation of an uptrend. The price descending channel was then broken at the £0.365 level.

Once these conditions are met, God willing, the stock will have a price target of between £0.455 and £0.47.

Resistance for the stock is £0.40

Stock support: £0.343

Stop Loss: Actual Stop Loss Daily: £0.332

🔹Disclaimer

This report is for illustrative purposes only and is not intended to constitute a direct invitation to buy or sell, or a recommendation to make a specific investment decision. All content contained in this report is believed to be reliable, but its accuracy or completeness is not guaranteed.

Any use of this information is the sole responsibility of the investor and we assume no obligation or commitment. This report is not considered personal investment advice, but an analytical judgment that may or may not be correct.