Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

🔍Technical Reading

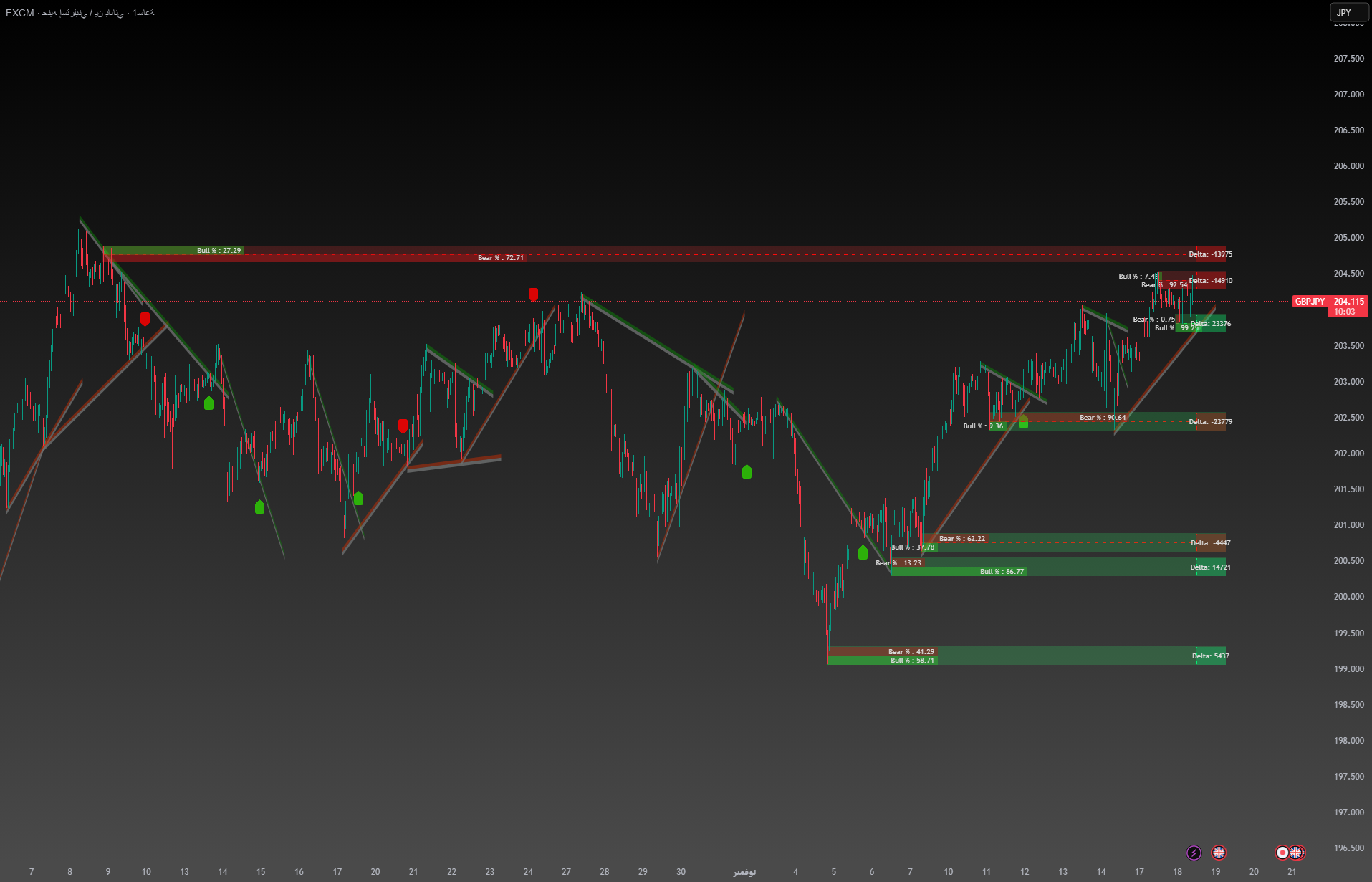

Price formed a series of rising tops and bottoms after retesting demand areas:

🔹 Main demand area (199.80 – 200.20)

The pair rebounded strongly, with clear positive delta values indicating the entry of heavy buying liquidity.

🔹Next support area (202.30 – 202.70)

This area supported the last leg of the advance and is considered a key level for the continuation of the bullish structure.

🔹Current display area (204.20 – 204.60)

There are heavy sell orders in this area, which has seen negative reactions before.

📈 Most likely scenario (bullish)

The price stabilizes above 203.40, the positive structure is under control and supports the possibility of another test of the supply zone.

First target: 204.60 (full retest)

Second goal: 205.20

Exceeding 205.20 may open the way to:

206.00 – 206.40

Positive delta values near support reinforce this trend.

📉 Alternate scenario (landing)

A break below 203.40 could send the price back:

202.70

Then comes the most important zone: 202.30 – 202.00

From there, buyers are likely to emerge again as long as the pair does not break above 200.20, which is the general structural area.

📌Conclusion

Current Structure: Bullish

Nearby support: 203.40

Strong callback area: 202.30 – 202.70

Upside target: 204.60 – 205.20

Breaking through 203.40 opens the door to adjustment