Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

───────────────────────

0) Opening – “I’m watching, baby”

───────────────────────

• SPX down around -0.9% → Risk aversion.

• VIX rises above 22 → Fear enters the hall and the audience screams.

• US10Y and US02Y fell slightly → Gold’s interest rate pressure has eased.

• DXY is at semi-flat → The dollar is not the hero of the scenario.

• Gold spot is around 4014-4015, GC1 is lower than GC2 → contango is normal, and there is no panic in the market outlook.

Translate with a XAUMO mentality:

The market treats itself like, “Look at it and see nothing.”

But VIX and Future said: There is selling pressure above…and now we are rebalancing around POC.

───────────────────────

1) FVRP plot on the chart

───────────────────────

Judging from the cards I sold:

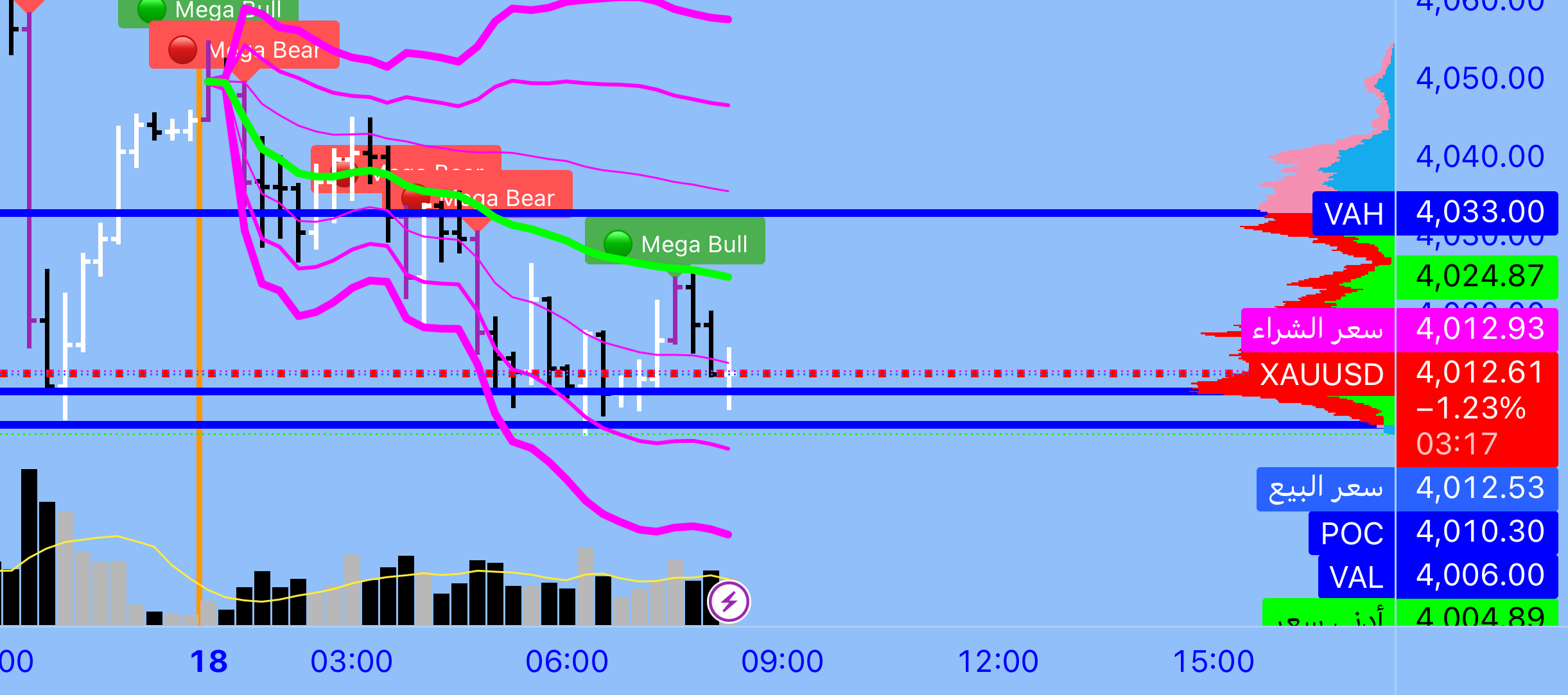

• Today’s POC: Approx. 4017–4018

→ This is the main stage, the price depends on it.

• Value: Approx. 4006

• Lowest so far: ~4004.8

→ We are now between VAL and POC. There are discounts in Zone, but there is still value in it.

• Magenta Band (VWAP/BB-VWAP) is falling → Bearish trend during London session.

• Footprints 06:30–08:00:

– I saw a clear negative delta in my first catarrh.

– Then buy Delta (593-414-508…) around noon on 4013-4015 Dear

→ I mean, did anyone get… “The person who sat in the front row and bought all the tickets” 😏

Read XAUMO FVRP:

1️⃣ Overall intraday trend: Bearish but exaggerated selling (possible exhaustion below).

2️⃣ Price is lower than POC and higher than VAL → Super value airline discount area = Reversion Scalps Stadium.

3️⃣ Volume Delta speaks in absorption, not surrender.

───────────────────────

2) Scenario A – long-term scalping (“I was accused and regretted” scenario)

───────────────────────

Scene creativity:

We bounce slightly from the discount zone (between VAL and POC) to bring the price back to POC.

🎯 Education entrance area (long)

• Entrance area: 4013.5 to 4011.5

– Gradually enter the market: half of the contracts are above 4013, and half are around 4011-4012.

🎯 Target(TP)

• TP1 (Tier 1): 4019–4020

– This is approximately POC + above current bid/ask price → reversal is normal.

• TP2 (Front Seat with Adel Imam): 4024–4025

– The high period/VAH is coming and resistance is visible on the profile.

🛡 Stop loss (risk mitigation)

• SL1 (Smart Lawyer): 4007.0

– Slightly lower than VAL; if there is a lock with a large negative value 15m/30m below it → the scene is invalid.

• SL2 tailgate (for those who want to leave some mental space): 4003–4002

– Completely beyond value; this is the last stop in the event of an outage.

⚖️Educational philosophy:

• R:R of 4013 →

– TP1: +6–7$

– TP2: +$11–12

– SL1: -6–7 USD

→ A respectable scalper would trade at half volume and keep some profits at TP1 and move the stop loss to breakeven.

👀 Confirmation of conditions for entry (checklist before saying “I object, your honor”):

1. The 5m/15m candle wick is below 4013 and the closing price is above 4013.

2. The Delta at the bottom remains green or is less negative than the previous candle (sign of absorption).

3. No new giant red footprints larger than 20-30K appeared in 4014-4012, and there was no upward reaction.

If these three items are verified → FVRP is accepted for long-term education admission.

───────────────────────

3) Scenario B – Short Break and Extended (“A Very Honest Bystander” Scenario)

───────────────────────

If the market decides to change the plot to tragedy:

🔻Scenario A failure signal:

• Break VAL 4006 with a heavy red 15m switch + strong negative delta (e.g. -20K or more)

• Then a small retracement from below to 4006-4008 failed, returning its value to Value.

Then FVRP will change with you:

🎯 Education login area (short)

• Entry zone: 4006–4008 (retest VAL from below).

🎯TP

• TP1: 3997-3995

• TP2: Approximately 3985 (former low profile/old volume area).

🛡SL

• SL1: 4012 (return value)

• SL2 Tailgate: 4016 Located directly above the POC if pinch occurs.

idea:

• As long as the price is lower than VAL and the trading volume is certain → the person holding the microphone is not the buyer… This is the role played by the director himself 😅

───────────────────────

4) Link the scene to the first position – Macro

───────────────────────

To remain a “witness who sees everything”:

1️⃣ SPX down + VIX up

→ Any bounce in gold today is likely to be a technical bounce rather than a new uptrend.

2️⃣ Declining returns → I support gold on the big box (4 hours/daily),

But that doesn’t mean we won’t see Flush in it today.

3️⃣ Curve GC1 < GC2 = normal contango

→ There will be no panic buying in the future, so we prefer to play FVRP instead of breakout hunting.

───────────────────────

5) XAUMO FVRP Checklist – version, see nothing

───────────────────────

Before entering, ask yourself like Adel Imam:

1.Where does the price of VAL/POC/VAH come from?

▸ Now between VAL and POC → Mean Reversion Stadium.

2. Under what factors does the volume increase?

▸ In absorption around 4013-4015? Or sell floods?

3. Micro trend (VWAP/band)?

▸ Next→ Long scalpers stay sane, not online grooms.

4. Macro Clicks (SPX/VIX/Yield/DXY)?

▸ Mild risk aversion → We don’t covet the legendary TP3… we run TP1/TP2 and be done with it.

If these four countries ride on top of each other → it says:

“I am a witness, Bey…I saw the deal in front of me, but it was limited to education” 🤝

───────────────────────

⚠️ Final warning – in the style of Adel Imam

───────────────────────

Guys…

XAUMO, FVRP, all of these are for explanation and training purposes only.

Anyone who actually trades without risk management…

Workers like Adel Imam went in to testify and saw nothing 😄

• Amount of risk per trade: 0.5% – 1% of maximum capital.

• If the breakout occurs violently, there is no average decline in Scenario B.

• Commitment to the plan is more important than hitting the target price.

🏁 So we ran XAUMO FVRP on the current scenario…

You can turn these levels into backtests or simulated trading and think of them as theater rehearsals…

The true quote is your responsibility.