Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Although global macroeconomic indicators such as global PMI data released on Friday may indirectly affect gold prices through the US dollar channel, market focus will be entirely on the US economy. As the U.S. government reopens, we expect other macroeconomic data to be released soon, including the September jobs report (excluding the unemployment rate), although some indicators are not yet available due to interruptions in data collection during the lockdown. It is worth noting that the comments of Fed officials have become somewhat hawkish recently. According to the Chicago Mercantile Exchange’s FedWatch Index, the probability of the Fed cutting interest rates by 25 basis points in December is 44.4%, while the probability of keeping interest rates unchanged is 55.6%. The probability of the Fed cutting interest rates by 25 basis points in January is 48.6%, the probability of keeping interest rates unchanged is 34.7%, and the probability of cutting interest rates by 50 basis points is 16.7%. In addition, geopolitical uncertainty may support gold prices this week. Gold itself generates no interest, typically performs well in low interest rate environments and is considered a safe haven during times of economic uncertainty. As the U.S. government shutdown ends, investors are awaiting clearer information on what to do with the accumulated economic data and how they will reflect the state of the U.S. economy. The two most important factors are the reopening of the U.S. government and the trade truce – two developments that signal risk aversion and should curb demand for safe-haven gold, but have not yet been fully reflected in gold prices, clearly indicating that the market is still betting on continued central bank purchases of gold. However, it is important to be careful that this assumption carries inherent risks, as central banks may remain cautious about the current rise in gold prices.

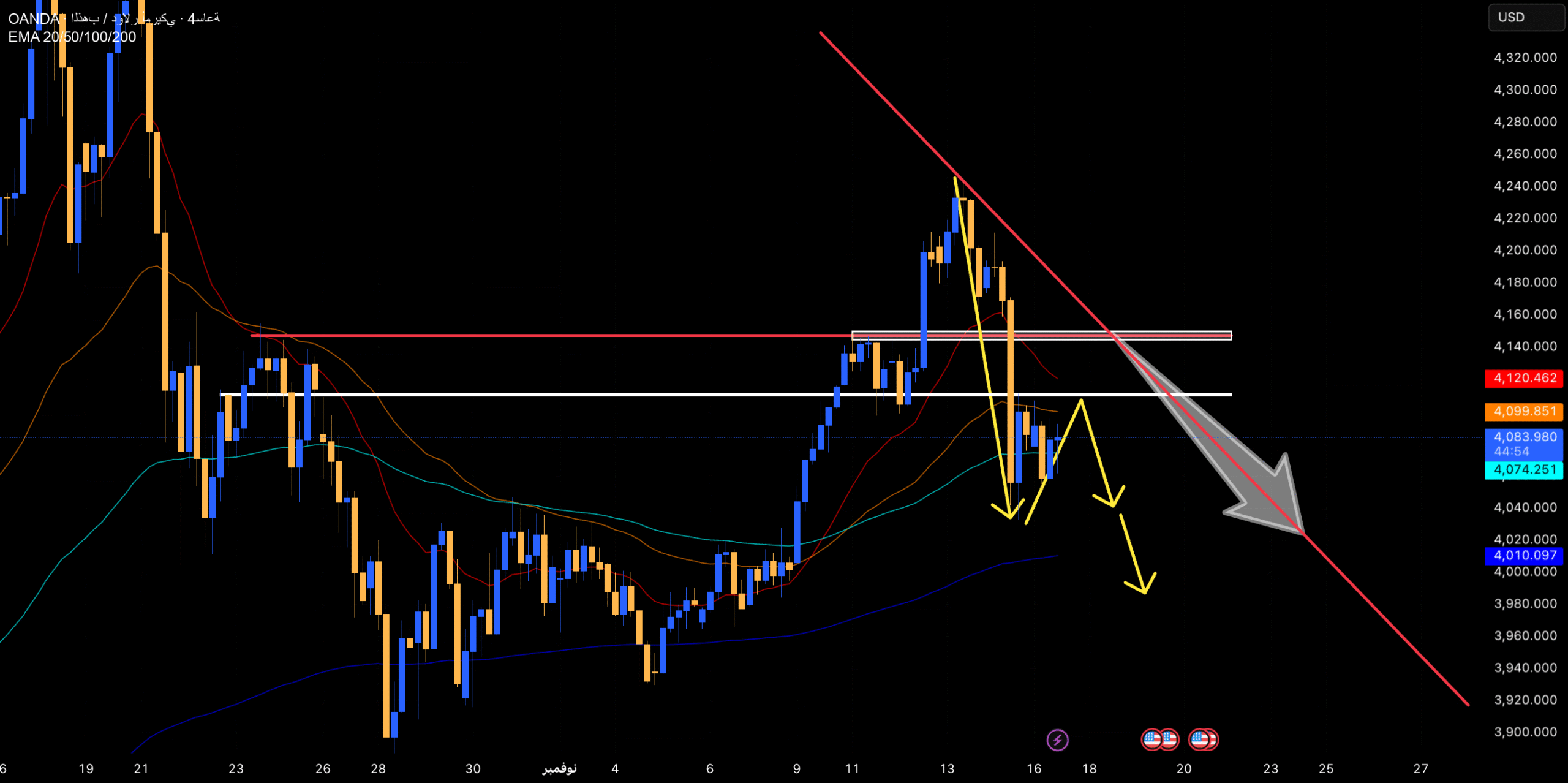

Gold price trend analysis: Although gold prices fell last Friday, gold prices closed higher this week, indicating that bullish sentiment currently dominates the market. Somewhat surprisingly, gold has shown resilience despite multiple negative factors. Gold prices rebounded from around 4032 after falling sharply last Friday, and then encountered resistance again near 4111 during the US session. At the opening today, prices did not fluctuate significantly, but moved within a narrow range as expected over the weekend. If bulls don’t see a big move higher this week, a major weekly correction will almost certainly begin. It should be noted that the previous week’s gains were larger, which means that the technical correction may be large. My strategy this week is still to sell on rallies. On Friday, we identified a sharp decline signal and shorted at 4210 and 4183. Shorting at 4183 resulted in a sharp unilateral decline. The first major support level for the current gold price correction is near 4,000 points. We will be relying on smaller resistance levels to sell today as a larger pullback is needed after a sharp decline.

Let’s briefly review the overall trend of gold during the Asian session. Basically in line with my expectations: a range-bound pattern, fluctuating within a certain range. It is clear that the 4110 level is an important resistance level, having failed to hold this level many times before. The 4050 mark provides relatively strong support and becomes the support level during the day. Our main strategy during the European session is to continue shorting rallies. If the decline continues, we will head towards the psychological $4000 level and even lower, the $3930-3887 area. In short, today’s short-term gold trading strategy is based on short selling when the price rises, and buying on dips as a secondary method. In the short term, the main focus is on the resistance level 4110-4150 and the main support level 4030-4000. Please strictly follow the trading rhythm.