Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

From a purely technical perspective, yes, the likelihood is high, but not necessarily immediate or impulsive. What is discussed here is not a trend reversal or price collapse, but a logical correction scenario following a strong and sustained upward wave that is consistent with historical price behavior and current market structure.

🔹First: Technical Reading

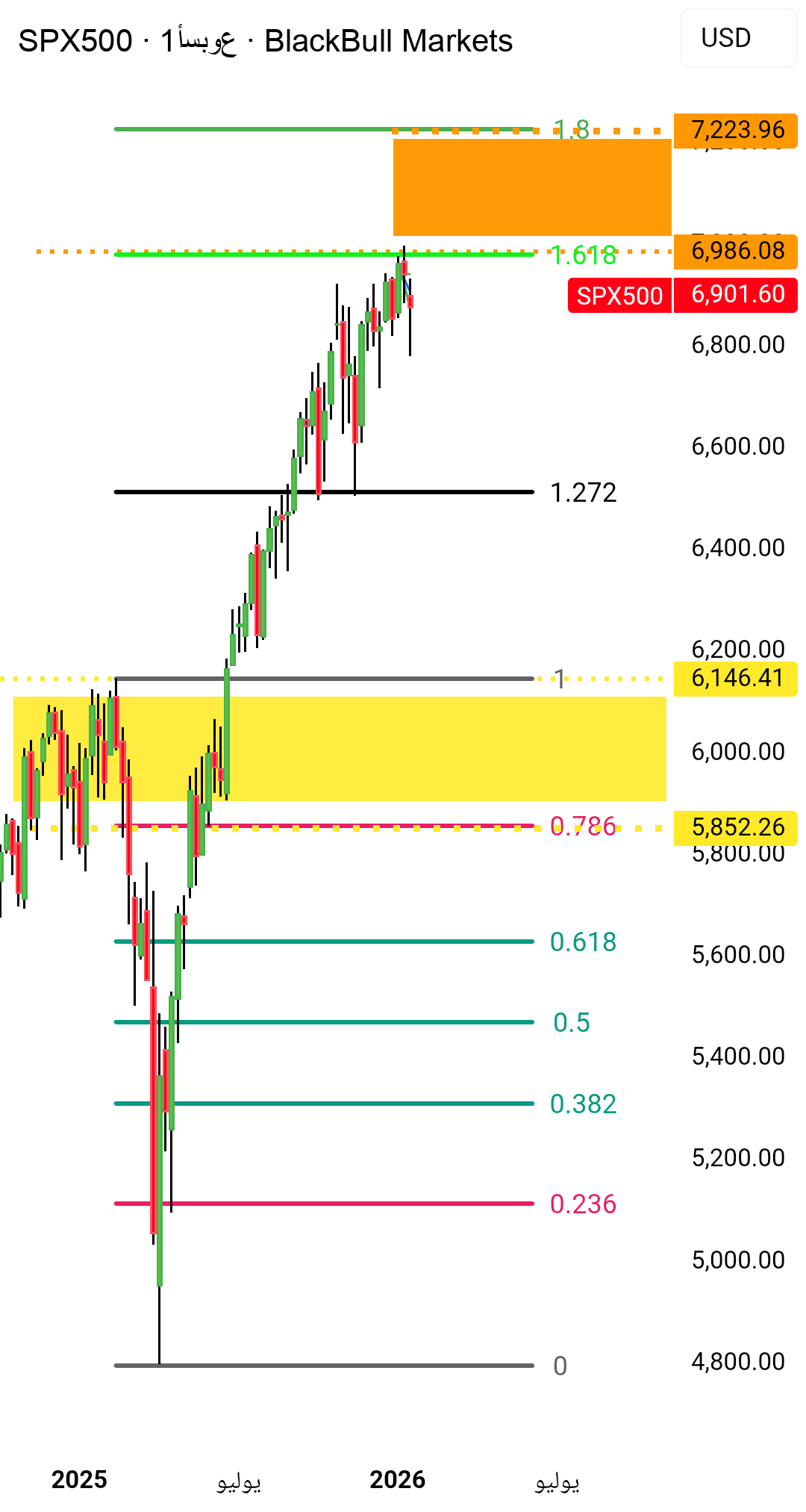

Fibonacci extension line 1.618 – 1.61 reached

Price is currently trading at the 161% Fibonacci extension of the last major bearish wave, an area that has historically been classified as overbought and often turns into a smart drainage area, starting with moderate to deep corrections. Markets rarely continue to rise above these percentages without stopping or correcting to restore price equilibrium and lessen the severity of the expansion.

Breakout of 6140 top, no need to retest

The top at 6140 represents historical resistance and the upper limit of the long-term trading range, with a breakout occurring on strong impulse momentum without a retest or the establishment of a supportive price foundation below it. This type of breakout is usually not technically complete unless it is followed by a move back to retest the level, or a deeper correction that brings price back to a fair value area where the market has not spent enough time stabilizing.

The 6100-5800 area is a typical correction area

Talk of the 6100 – 5800 area is not based on random numerical assumptions, but on a strong structural area that combines clear horizontal support, previous accumulation and release ranges, in addition to the convergence of the 0.786 Fibonacci level with the broken historical peak turned support, and the institutional price acceptance area. Technically, any decline toward these levels is classified as a correction within an uptrend rather than a trend reversal signal.

🔹Second: Historical Price Behavior

When examining previous peaks that formed on advanced Fibonacci extensions, rising vertically without phased corrections, we observe a repeating pattern of strong pulsating waves, often followed by corrections of 8% to 15%, and then continuation of the uptrend on a more balanced basis. This historical behavior reinforces the logic of targeting the 5800-6100 point area as a natural and potential correction target.

🔹Third: Contextual reading (macro context)

Overall, markets live in an environment rife with geopolitical tensions and global economic instability, and any surprising news or potential political development could trigger a correction. At the same time, a large portion of blue-chip companies have reached all-time peaks, weakening the risk-reward equation and increasing the likelihood of institutional profit-taking and repricing.

🔹Expected scenarios

Positive Scenario (Currently Least Likely)

The performance is that the price consolidated above 7000 points and established a clear price basis, and then broke through above 7250 points in an orderly and clean manner with the support of strong momentum, new liquidity and good news.

Technically Possible Situations

That is, the price failed to stabilize above 7250, and then broke through the short-term structure and entered a gradual correction, first targeting the 6100 area, and may extend to as high as 5800 in the later period, while maintaining the overall upward trend in the large range.

✍️Final conclusion

A return to the 6100-5800 level for the S&P 500 is not viewed as a negative scenario, nor does it reflect excessive pessimism, but rather represents a healthy and necessary adjustment to restore balance after a prolonged upswing.

By their very nature, markets don’t move in a straight line, but they breathe, correct, and then move on.